Floriane

The BlackRock Innovation & Growth Trust (NYSE: BIGZ) is a venture capital fund wrapped in a CEF structure providing investors with exposure to pre-IPO investments not typically available to retail investors. It also yields an attractive current yield of 12.3% financed by return of capital.

During bull stock markets, pre-IPO venture capital investments can add significant returns to a portfolio, as start-up companies may seek exits through sales to other companies or IPOs on public markets. Unfortunately, the IPO market is currently in a deep freeze, and big tech companies are more concerned with cutting costs than acquiring startups. I would stay away from the BIGZ fund until the market environment improves and exits become viable again.

Fund Facts

The BlackRock Innovation & Growth Trust is a closed-end fund (“CEF”) that invests primarily in small and mid-cap companies that the investment manager deems “innovative”.

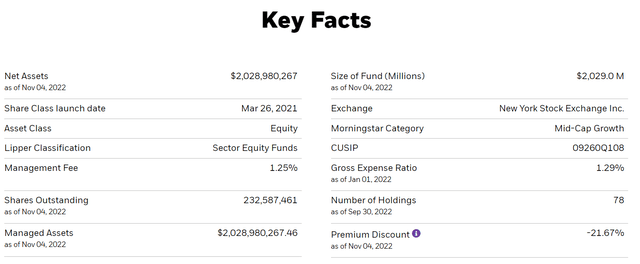

The fund has over $2 billion in assets and trades at a steep 21% discount to net asset value (Figure 1).

Figure 1 – Key Facts of BIGZ (blackrock.com)

Strategy

The investment objective of the BIGZ fund is to provide total return through a combination of income, current gains and long-term capital appreciation. To achieve its investment objective, the fund will invest primarily in companies which have introduced or are seeking to introduce a new product or service which may change their respective market. The fund also writes call options on investment holdings to generate current income.

Portfolio holdings

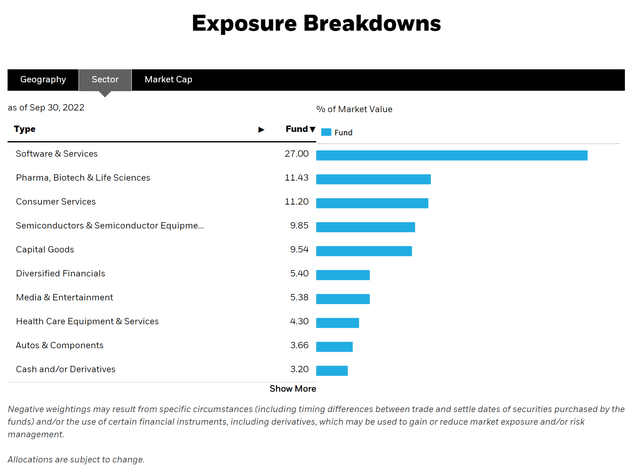

As the fund aims to invest in innovative companies, its portfolio holdings resemble those of a “technology” or “growth” fund, with large allocations to software (27.0%), biotechnology (11 .4%), consumer services (11.2%), and semiconductors (9.9%).

Figure 2 – BIGZ fund sector exposure (blackrock.com)

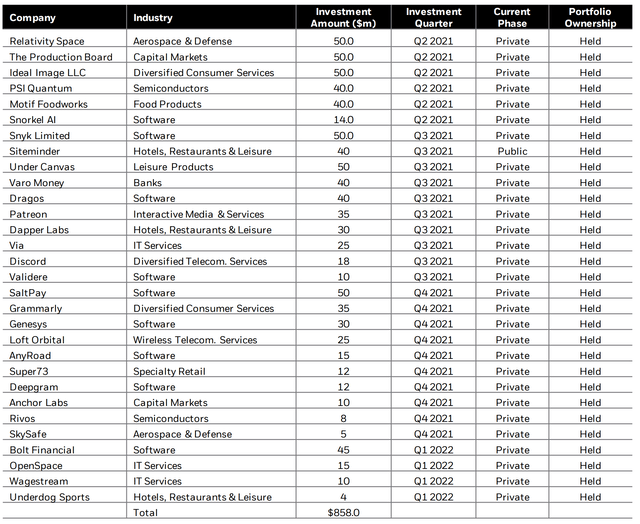

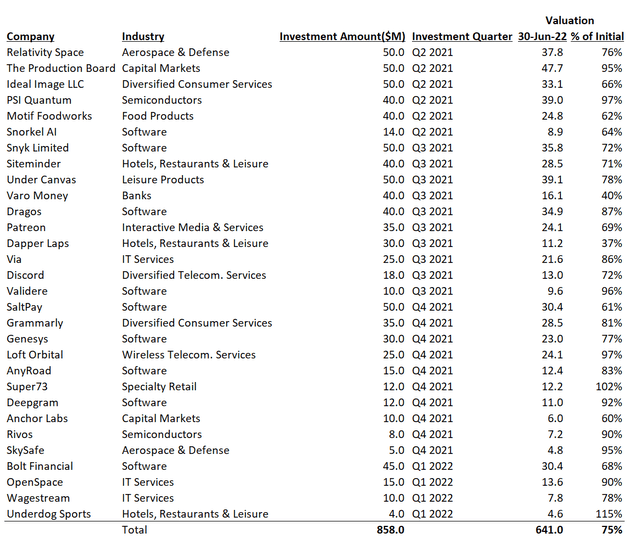

Another characteristic of the BIGZ fund is its significant weight in private investments. The fund aims to invest up to 25% of its assets in private placements. At the end of the second quarter of 2022, the fund’s allocation to private companies was 27.4%, as the value of public investments fell. In total, the fund has invested $858 million in 29 private companies as of June 30, 2022 (Figure 3).

Figure 3 – BIGZ private investments (blackrock.com)

Return

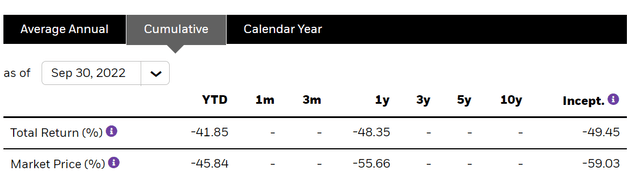

The BIGZ fund was only launched in March 2021, so it has a limited operating history. However, in the short period of the fund’s existence, it has lost approximately half of its value (based on net asset value, the fund has lost 49.5% since inception), most of the losses producing since the beginning of 2022 (Figure 4).

Figure 4 – BIGZ Returns (blackrock.com)

Distribution and yield

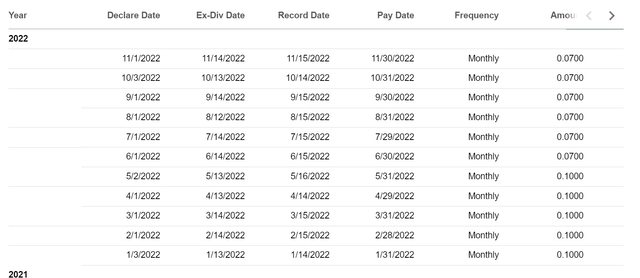

One of the main attractions of the BIGZ fund is its high distribution yield. However, the $12 million distribution figure of $1.05/share is misleading, as the monthly distribution was reduced from $0.10 to $0.07 in June 2022 (Figure 5). At the current distribution rate of $0.07/month, the fund is earning 12.3% on market price and 9.6% on net asset value.

Figure 5 – Distribution of BIGZs in 2022 (Looking for Alpha)

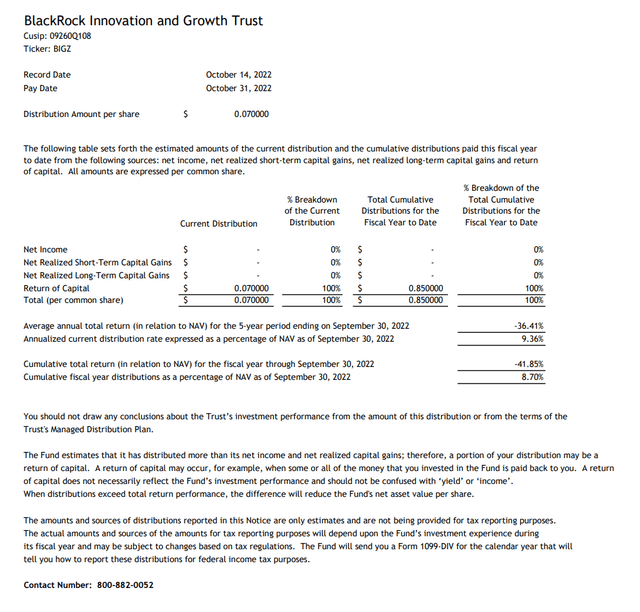

The distribution of BIGZ is financed by a return of capital (“ROC”) (Figure 6).

Figure 6 – BIGZ distribution is funded by return of capital (blackrock.com)

Costs

The BIGZ fund charges a management fee of 1.25% and has a gross expense rate of 1.29%.

Private investments are high risk and high return

As I’ve written before, pre-IPO private investments can offer phenomenal returns. For example, Sequoia Capital turned a $60 million investment in messaging app WhatsApp into $3 billion when WhatsApp was sold to Facebook in 2014. However, venture capital investment also comes with risks, because venture capital returns follow the Pareto principle, where 80% of returns come from 20% of investments. Often a venture capital fund will lose money on most of its investments, but 1 or 2 home runs will “carry the fund”, and more. Unfortunately, it is impossible to know in advance which investment will win and which will lose.

One of the main disadvantages of venture capital investing is the unpredictable nature of cash flows and why it is not available in a mutual fund/ETF environment. Since most of these investments are in early-stage, high-growth companies, the investments typically do not pay dividends and rarely generate profits. Instead, venture capital funds rely on “exits”, either a sale of the investment to a bigger company like WhatsApp/Facebook, or a public listing (via IPO or SPAC) of the company. investment, to generate cash flow and returns for investors. The timing of exits is unpredictable and usually requires a “bull market” environment. Investors in venture capital funds must exercise extremely high patience and tolerance for long periods of little or no cash.

BIGZ is a venture capital fund in disguise

What’s interesting about a fund like BIGZ is its attempt to wrap an illiquid venture capital fund in a perpetual closed-end fund structure. The CEF structure means investors in BIGZ cannot redeem their units like in a mutual fund. When investors want their capital back, they sell shares of the fund to someone else, and the capital stays in the fund; there is no forced liquidation of the funds’ investments.

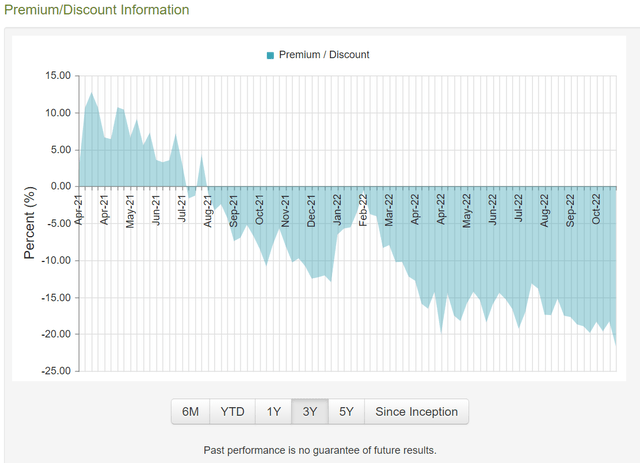

The worst that can happen to a CEF is that it trades at a significant discount to the fund’s net asset value because there is no “demand” for the fund’s shares. Currently, the BIGZ fund is trading at a steep 21% discount to NAV (Figure 7).

Figure 7 – BIGZ discount on NAV (cefconnect.com)

The steep discount could also be a sign that investors in the funds do not trust the mark-to-market valuation of the funds’ private investments. For example, in the BIGZ fund, according to the latest semi-annual report as of June 30, 2022, the private investment portfolio was marked at 75% of the initial investment (Figure 8).

Figure 8 – Valuation of BIGZ private investments (Author created with data from the half-year report as of June 30, 2022)

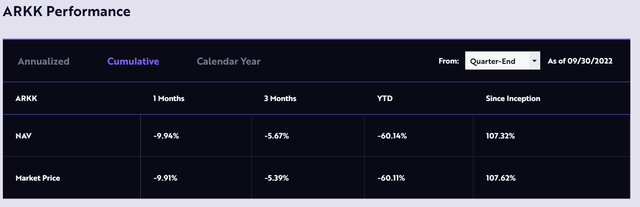

However, we know from peer tracking of public “innovation” funds like the ARK Innovation ETF (ARKK), that 2022 has been a disastrous year, with ARKK returning -60.1% since the start of the year as of September 30, 2022 (Figure 9).

Figure 9 – ARKK ETF 2022 returns (ark-funds.com)

It is highly unlikely that BIGZ, with a 25% weighting in private investments which should make it more risky, could outperform the ARKK ETF by almost 20% with a return of -41.9% YTD as of September 30, 2022. Therefore, skeptical investors punished the BIGZ fund by reducing its market price by 59.0% YTD (similar to ARKK’s YTD performance).

Conclusion

In conclusion, The BlackRock Innovation and Growth Trust is a disguised venture capital fund offering investors exposure to venture capital investments not generally available to retail investors. It also offers an attractive current yield of 12.3% financed by return of capital.

During bullish stock markets, venture capital investments can add significant returns to a portfolio, as start-up companies may seek exits through sales to other companies or IPOs in public markets. Unfortunately, the IPO market is currently paralyzed and big tech companies are more concerned with cutting costs than acquiring startups. I would stay away from the BIGZ fund until the market environment improves.